- Software Gestor para Aquicultura

- (85) 2139-6730

- contato@despesca.com.br

Economic Feasibility Analysis: A Step-by-Step Guide to Planning a New Aquaculture Project or Expanding Your Farm

Cost Per Kilo: Do You REALLY Know How Much It Costs to Produce Your Shrimp?

11/09/2025

HACCP (Hazard Analysis and Critical Control Points): Implementing a Food Safety System on Your Farm

15/09/2025Aquaculture is one of the fastest-growing productive activities in the world, driven by the increasing demand for quality fish. However, the success of an aquaculture venture, whether a new project or the expansion of an existing farm, directly depends on careful planning and a robust economic feasibility analysis. Ignoring this crucial step can lead to misguided investments and significant losses.

This detailed guide offers a step-by-step approach to conducting a comprehensive economic feasibility analysis, ensuring your decisions are based on concrete data and realistic projections.

1. Market Study and Product Definition

The first step is to understand the market. Before investing, it’s essential to research the demand for the species you intend to cultivate (shrimp, tilapia, etc.), identify key competitors, analyze existing distribution channels, and understand price dynamics. Clearly define your product: will it be sold live, fresh, chilled, or frozen? For which audience: local market, regional, restaurants, or export? This definition will impact the entire cost structure and marketing strategy.

2. Estimating Initial Investment (CAPEX)

Capital Expenditure (CAPEX) represents all the investment required to start or expand operations. It is crucial to list and budget all items in detail, which may include:

- Licensing and Regularization: Costs associated with environmental licenses, permits, and other legal authorizations.

- Infrastructure: Land acquisition, construction of ponds, tanks, laboratories, offices, and sheds.

- Equipment: Purchase of aerators, pumps, feeding systems, water monitoring equipment, graders, and vehicles.

- Broodstock and Post-larvae/Fingerlings: Initial investment in quality genetic stock.

Accurate surveying of these costs prevents surprises and ensures that initial capital is sufficient to put the project into operation.

3. Projecting Operational Costs (OPEX)

Operational Expenditure (OPEX) comprises the recurring expenses necessary to keep the farm running. Correctly projecting these costs is vital for the business’s financial health. The main components are:

- Feed: Usually the largest single production cost, potentially representing over 60% of OPEX.

- Labor: Salaries and charges for the entire team (manager, technicians, operators).

- Electricity: Cost for operating pumps, aerators, and other equipment.

- Inputs: Probiotics, prebiotics, fertilizers, pH correctives, and other chemicals.

- Maintenance: Preventive and corrective costs for equipment and infrastructure.

- Administrative Expenses: Taxes, insurance, marketing, and sales.

Using a management software like Despesca is fundamental at this stage, as it allows for accurate recording and categorization of all costs, generating a reliable history for future projections and optimizing financial control of the production cycle.

4. Revenue Analysis and Break-Even Point

With costs defined, the next step is to project revenues. This projection must be realistic, based on the farm’s productive capacity, expected survival rates, average harvest weight, and estimated selling price.

Based on cost and revenue projections, the Break-Even Point is calculated, which is the minimum production volume the farm needs to sell to cover all its costs, without generating profit or loss. Knowing this number is essential for setting production and sales targets.

5. Economic Feasibility Indicators

To evaluate whether the investment is worthwhile, key financial indicators are used:

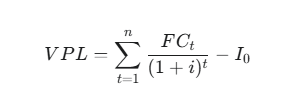

- Net Present Value (NPV): Brings all future cash flows of the project to the present value, discounting a rate of attractiveness (opportunity cost of capital). A positive NPV indicates that the project is viable.

Where CFt is the cash flow in period t, i is the discount rate, n is the number of periods, and I0 is the initial investment.

- Internal Rate of Return (IRR): This is the discount rate that makes the NPV equal to zero. The IRR must be higher than the minimum attractive rate for the project to be considered attractive.

- Payback Period: Indicates the time required for the project’s accumulated profit to equal the initial investment. The shorter the payback period, the faster the return on invested capital.

Conclusion: Planning as the Key to Success

Economic feasibility analysis is not just a bureaucratic exercise but an indispensable strategic tool for success in aquaculture. It allows producers to make informed decisions, identify risks, seek financing more effectively, and optimize resource allocation.

Management tools like Despesca are powerful allies in this process, centralizing cost, production, and stock data, which facilitates the creation of accurate projections and real-time monitoring of results. Careful planning is the first major step towards building a profitable and sustainable aquaculture business.